Company Overview

As Korea's leading credit-specialized financial company, Hyundai Capital has maintained its undisputed No.1 position in the auto finance market since launching installment financing business for the first time in Korea in 1996.

It is the financial arm of Hyundai Motor Company, KIA, and Genesis, providing services and products focusing on auto finance, while also offering credit loans and mortgage loans.

Hyundai Capital is actively pursuing digital transformation in all business areas, and leading digital innovation in the auto finance industry by strengthening data science and digital capabilities. Under the vision of 'Global Leader in Mobility Finance', Hyundai Capital has become Korea's largest global financial company, operating 15 entities and 2 branches in 14 countries around the world.

In line with the Hyundai Motor Group's overseas business strategy, Hyundai Capital is successfully performing its role as the captive finance company of the Group, and through such efforts has achieved the remarkable performance of KRW 158 trillion in global assets (Asset as of 2023 closing).

In 2023, Korea Investors Service, NICE Credit Ratings, and Korea Ratings, the three major credit rating agencies in Korea, raised Hyundai Capital's credit rating from AA Positive to AA+ Stable.

Global ratings leaders Moody's and Fitch upgraded Hyundai Capital's rating from Baa1 (Positive) to A3 (Stable) and BBB+ (Positive) to A- (Stable) respectively, while S&P also lifted its outlook from BBB+ (Stable) to BBB+ (Positive), so that Hyundai Capital achieved the Triple Crown feat of having its credit rating raised by the global Top 3 rating agencies (As of March 2024).

Hyundai Capital will ceaselessly strive to take on new challenges around the world.

Corporate History

- 2024.06 Launched a dedicated product called 'E-Value loan' for 'The Kia EV3'

- 2024.05 Launched a dedicated purchasing program called 'Triple zero' for Kia 'The New EV6'.

- 2024.04 Issued green bonds worth a total of KRW 370 BN

- 2024.03 Signed 'an agreement to increase purchase of products manufactured by people with severe disabilities' with Korea Disabled People's Development Institute '

- 2024.03 Launched a dedicated finance product for Kia EV called 'E-Life Solution'

- 2024.03 Launched a dedicated product for HMC EV called 'EV All-in-One Lease/Rent'

- 2024.03 Fitch Ratings raised credit rating from 'BBB+(P)' to 'A-(S)'

- 2024.02 First company in the finance sector that acquired A in Ministry of Science and ICT data quality certification

- 2024.02 First financial company in the world awarded with the Innovative Applications of Artificial Intelligence (IAAI) at the Association for the Advancement of Artificial Intelligence (AAAI) for two consecutive years

- 2024.02 Moody's raised credit rating from 'Baa1(P)' to 'A3(S)'

- 2024.01 Standard & Poor's raised credit rating from BBB+(S) to BBB+(P)

- 2024.01 Issued global bonds worth a total of USD 1BN

- 2023.11 Awarded as Best Governance Company in the Finance category by Korea Institute of Corporate Governance and Sustainability

- 2023.11 Acknowledged as the Best Practice Company in the Sustainable Finance category at the UN Global Compact Korea Leaders Summit 2023

- 2023.10 Issued KRW 1TN in ABS backed by New Car Retail receivables

- 2023.10 Established Hyundai Capital Indonesia (HCID)

- 2023.09 Selected as a target company for the "Asian Bond Revitalization Program" organized by Singapore's Monetary Authority (MAS)

- 2023.08 Hyundai Capital Services and GS Caltex signs memorandum of understanding (MOU) to strengthen cooperation in the electric vehicle sector

- 2023.08 Offered opportunities to realize shareholder value for minority shareholders through share buybacks worth KRW 11.2 billion

- 2023.07 Launched 'E-FINANCE', financial program dedicated to electric vehicles

- 2023.07 Provided financial support for customers affected by storm damage

- 2023.07 Issued Sustainable Linked Bonds (SLB) Public Offering worth a total of KRW 220 billion for the first time in Korea

- 2023.07 Hyundai Capital App revamp user experience (UX)

- 2023.06 Hyundai Capital Canada (HCCA), U.S. JD Power's "No. 1 local dealer satisfaction"

- 2023.05 Launched 'Hybrid Low Rate Installment for Kia' product

- 2023.04 Issued green bonds worth 200 million Swiss Fran

- 2023.04 Achieved triple-crown of credit rating upgrade from Korea’s top three credit rating agencies

- 2023.04 Launched COMBINED RATE STATION-TYPE INSTALLATION PRODUCT

- 2023.03 Fitch raised outlook for Hyundai Capital Services’ ratings

- 2023.03 First in the financial sector to issue KRW 600 billion worth of green bonds in accordance with ‘K-Taxonomy’

- 2023.03 Hyundai Capital Services’ NICE credit rating rose to AA+

- 2023.02 Moody’s raised outlook for Hyundai Capital Services’ ratings

- 2023.02 Announced New Corporate Vision 2023 (Global Leader in Mobility Finance)

- 2023.02 Launched 2nd-tier customer panels including senior citizens for the first time in the industry

- 2023.02 First Korean financial company to win the "International Artificial Intelligence Society" >Innovative Artificial Intelligence Application Award<

- 2023.02 launched floating rate new car installment product for the first time in the industry

- 2022.12 Receives ‘Customer Centered Management (CCM)’ certification

- 2022.11 Signs MOU with Korea Inclusive Finance Agency to support financially alienated class

- 2022.10 Issues 20 billion yen worth samurai bonds

- 2022.10 Launches customer protection early warning system ‘Canary Maestro (CAM) 2.0’

- 2022.10 Launches Casper-exclusive lease program

- 2022.10 Open new graduate recruitment for the second half of 2022

- 2022.09 HQ relocated to the 'Grand Central' building near Seoul station

- 2022.09 HCS-Kamco signed a business agreement to support vulnerable and overdue borrowers

- 2022.08 HCS app upgrades to 'automotive specialized financial information platform'

- 2022.07 Interest-free installment plan product launch

- 2022.07 HCS joined UNGC

- 2022.06 Issues CHF-denominated bonds worth 200 million

- 2022.04 Introduces platform based “Convenient Loan Comparison” service

- 2022.03 Launches Hyundai Capital App 2.0

- 2022.03 Issues AUD-denominated bonds worth 200 million

- 2022.03 Coordinates financial services consumer panel for the first time in the industry

- 2022.02 Launches low interest rate promotion for use of all models of Hyundai Motor, Genesis, and KIA

- 2022.01 Issues USD-denominated bonds worth 700 million

- 2022.01 Enters French market in cooperation with Societe Generale Group

- 2022.01 Extends long term rental ‘K-Solution’ program and launches installment/lease/rent promotion for January

- 2021.12 Launches AI-based call center system “AI Automated Happy Call”

- 2021.12 Obtains “ISO37301” certificate for the first time in the industry

- 2021.12 Awarded “Outstanding Company” at the ESG Awards 2021 by Korea Corporate Governance Service

- 2021.11 HCS obtains A+ rating in the ESG evaluation for three years in a row

- 2021.11 Launches “K-Solution” program for Kia customers HCS obtains A+ rating in the ESG evaluation for three years in a row

- 2021.09 Issues KRW-denominated sustainable bonds worth 280 billion

- 2021.08 Hyundai Capital Services launches finance program exclusively for Kia EVs

- 2021.07 Hyundai Capital Services launches Hyundai Motor 'N'-exclusive car finance product 'N-FINANCE'"

- 2021.06 Launches a car lease product allowing customers to return without paying fees

- 2021.06 Wins recognition given by the Minister of Environment for its contribution to promoting green business

- 2021.06 Launches 'installment-like lease' product which combines benefits of installment and lease"

- 2021.05 Launches 'installment-like lease' product which combines benefits of installment and lease"

- 2021.05 Signs an MOU applies to V2G pilot project for Jeju Special Self-Governing Province's business vehicles"

- 2021.04 Issues KRW-denominated green bonds worth 300 billion

- 2021.02 Issues global green bonds worth 600 million

- 2021.01 Launches Genesis-exclusive finance product 'Hyundai Capital G-FINANCE'

- 2020.10 Issues KRW-denominated green bonds worth 200 billion

- 2020.09 Participates in a feasibility study for on-demand charging service

- 2020.06 Issues CHFdenominated green bonds worth 300 million

- 2020.06 Issues KRWdenominated sustainable bonds worth 230 billion

- 2020.04 Launches AI-enabled “vehicle image reading system”

- 2020.04 Hyundai Capital achieves '50 trillion' in Global assets

- 2020.03 Introduces global IT standard platform

- 2020.02 Hyundai Capital Bank Europe(HCBE) enters into an agreement to acquire Sixt Leasing SE's shares

- 2019.12 Issues KRWdenominated green bonds worth 200 billion

- 2019.10 Signs an MOU for leasing micro electric vehicles for mail delivery

- 2019.09 Opens “Digital Auto Finance” web site, which offers integrated auto finance services for new car purchases "

- 2019.07 Signs an MOU to introduce micro electric vehicles

- 2019.05 Signs an MOU to introduce eco-friendly delivery vehicles

- 2019.04 Issues KRWdenominated green bonds worth 300 billion

- 2019.04 Sets up Banco Hyundai Capital Brasil, BHCB

- 2019.01 Issues CHFdenominated green bond worth 200 million

- 2018.12 Launches digital-based used car loans

- 2018.07 Launched ‘Auto Book’, an AI-based used car price search service

- 2018.04 Launched "FCEV/EV leasae product" for the first time in the industry

- 2018.01 Signed a HCS-Korea Transportation Safety Authority-Seoul National University MOU to develop used car prices system utilizing AI

- 2017.09 Launched an ‘Actual Used Car in the Market’ search service

- 2016.12 Received Environment Ministry award for electric car promotion

- 2016.10 HCBE received the banking license from ECB for the first time as a non-EU financial institute

- 2016.05 Hyundai Capital issued kangaroo bond(amounts to 350 million Australian dollars)

- 2016.04 Renewed Hyundai Capital CI

- 2016.03 Issued First Korean Corporate Green Bond (amounts to $500 million)

- 2015.10 Launched lease program for small commercial vehicles

- 2015.02 Launched Korea's first Electric car Lease program

- 2015.01 S&P raised credit rating to A-(S)

- 2014.10 S&P raised credit rating to BBB+(P)

- 2014.01 HCUK, first-issued ABS in England as a Korean financial firm

- 2013.07 Completed construction of 'CASTLE OF SKYWALKERS', a multi-functional base camp of SKYWALKERS

- 2013.05 Hyundai Capital issued Asia's first kangaroo bond(amounts to 250 million Australian dollars)

- 2012.09 Moody's raised credit rating to Baa1(S)

- 2012.09 JCR raised credit rating to A+(S)

- 2012.09 Established BHAF(Beijing Hyundai Auto Finance) with Beijing Automobile Works

- 2012.07 Hyundai Capital to merge GE Capital Korea

- 2012.07 Established Hyundai Capital UK with Santander bank

- 2010.03 Domestic credit rating upgraded to AA+

- 2009.09 Established Hyundai Capital Germany GmbH with Santander bank

- 2005.11 Received BBB(S) credit rating from S&P

- 2005.08 Received Baa3(S) credit rating from Moody's

- 2005.02 Received A-(S) credit rating from JCR

- 2004.08 Formed strategic alliance with GE Capital

- 1999.01 Changed company name to HYUNDAI CAPITAL SERVICES, Inc.

- 1995.04 Changed company name Hyundai Financial Services Co.

- 1993.12 Founded Hyundai Auto Finance Co. Ltd

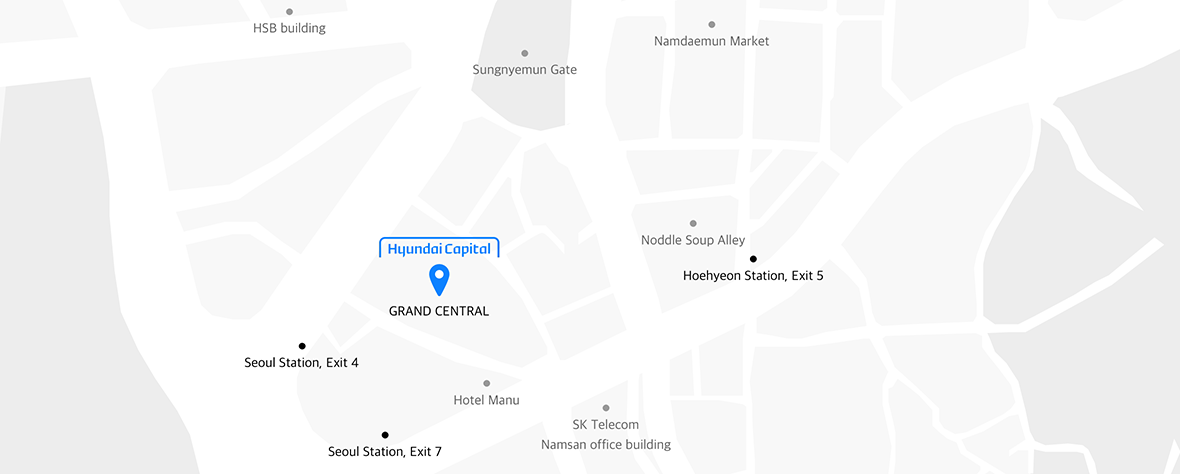

- Location of Headquarters

-

14, Sejong-daero, Jung-gu, Seoul, Republic of Korea (GRAND CENTRAL)

- Bus : Sungnyemun Station 7011, 402, 405, 708, 799, 103, 105, 173, 201, 202, 261, 262, 400, 401, 406, 701, 704, 7017, 7021, 7022, N75, N15, N16, N30

- Subway : Exit 4 of Seoul Station on Line 1